We developed this page to help you understand how to get Corona Virus Crisis financial relief for your small business. You are under extreme financial stress as a business owner and we want to help reduce it for you. Keep checking back as more information is received daily and you’ll find the most current information.

We developed this page to help you understand how to get Corona Virus Crisis financial relief for your small business. You are under extreme financial stress as a business owner and we want to help reduce it for you. Keep checking back as more information is received daily and you’ll find the most current information.

To begin, you can choose from a variety of different options. Which option best suites you and your business depends on the financial state of your business prior to this unprecedented disruption in the economy, and how you reacted to these events. Click the link if you need help figuring this out for your business.

- Economic Injury Disaster Loans (EIDL)

- Paycheck Protection Program (PPP)

- Florida Disaster Relief

- Other Useful Resources

- Personal Relief for you and your family

Remember that our founder, Dino Eliadis, has been pounding the drum from day one that you should not be cutting back haphazardly. Instead you should be evaluating your business operationally to determine where capacity has dropped and begin there. Click the link to watch the Facebook LIVE we recorded back on March 23, 2020 about how to reduce the impact to your topline revenue.

Remember that our founder, Dino Eliadis, has been pounding the drum from day one that you should not be cutting back haphazardly. Instead you should be evaluating your business operationally to determine where capacity has dropped and begin there. Click the link to watch the Facebook LIVE we recorded back on March 23, 2020 about how to reduce the impact to your topline revenue.

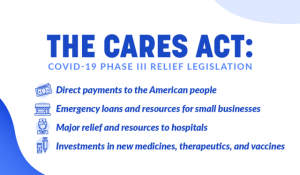

Additionally, remember this is a temporary event, so you will need resources when this is all over with to ramp back up and recover. Cut strategically and use the financial resources that have been brought to bear by the CARES Act to help you weather the storm and build back stronger!

Business Growth Simplified (BGS) Bookkeeping is here to help you sort through all the noise and find the solution that will best serve your financial needs. Then we can help you get organized with what you need to apply.

Corona Virus Crisis Financial Relief for Small Business

The CARES Act provides loan programs to help every type and size of business, including: sole proprietors, independent contractors, and non-profits.

Very good resources available at US Chamber if Commerce. Just click link to find out more.

Very good resources available at US Chamber if Commerce. Just click link to find out more.

Economic Injury Disaster Loans (EIDL)

- Economic Injury Disaster Loans (EIDL) which are already available through SBA who has the ability to provide a $10,000 advance to those who have applied for EIDL loans.

- SBA application page to submit your EIDL application

- Resources at SBA to apply and monitor your application for EIDL

Paycheck Protection Program (PPP)

- Paycheck Protection Program (PPP) loans created by the new law and forgives loans when small business owners continue to pay their rent and employees.

- Click here for Frequently Asked Question about how and when businesses can apply for PPP loans.

- Details of the CARES legislation

- Guideline posted by the U.S. Treasury Department regarding the PAYCHECK PROTECTION PROGRAM (PPP)

- You SHOULD NOT be charged to apply. If you are asked to pay the person asking to file your application RUN AWAY…this is illegal according to government documentation.

Florida Specific Corona Virus Financial Relief Resources

Here is a good video from Small Business Development Center (SBDC) Florida CEO Michael Myhre about the Florida Emergency Bridge Loan Program available to Florida small business owners.

Gain access to many of the resources mentioned on this page via this one-stop-shop link to get access to these tools for Florida businesses.

Pinellas County Grant

The county is making available $5,000 grant for business that qualify. Click the link to find out the qualifications and submit your application. If you need help figuring it out schedule a FREE consult on the form at the bottom of this page.

https://covid19.pinellascounty.org/pinellascaresbusiness/

Other Helpful Resources of Financial Assistance

Here are a number of other financial resources available for small businesses even before the outside of the Corona Virus Crisis financial relief tools before the CARES Act. The relief from the bill passed last week make more sense for most business owners, but these are other resources you may which to explore until specific submission guidelines are available later this week. They may provide you an overview of what you’ll need to submit your application.

Here are a number of other financial resources available for small businesses even before the outside of the Corona Virus Crisis financial relief tools before the CARES Act. The relief from the bill passed last week make more sense for most business owners, but these are other resources you may which to explore until specific submission guidelines are available later this week. They may provide you an overview of what you’ll need to submit your application.

SBA Loan Assistance:

- https://www.sba.gov/disaster/apply-for-disaster-loan/index.html

- https://www.benefits.gov/benefit/1504

Legal Updates for Crisis

- To stay up to date on legal impact from corona virus impacting you and your business a Florida law firm posts regular updates to legal matters you should be aware of during this crisis. Click this link for more legal updates.

Things to Consider When Getting Your Package Ready

To submit your application package, no matter which option you decide on, you will need to pull together your current personal and business documentation. We recommend you get started on gathering this material right away. At a minimum you will need the following:

To submit your application package, no matter which option you decide on, you will need to pull together your current personal and business documentation. We recommend you get started on gathering this material right away. At a minimum you will need the following:

- Personal Tax Returns from past 3 years

- Business Tax Returns for past 3 years or less if business open in past 3 years

- Financial reports (P&L and Balance Sheet) for 2019 and 2020 year to date

- Current cash flow statement if you have one (BGS Bookkeeping can help you create one if needed)

- Your payroll reports from last 6 months

- Review your credit score

We want to be truthful with you. If you had financial trouble before the crisis, or did your bookkeeping to minimize your taxes, then you many not qualify.

This is the reason we created BGD Bookkeeping. We often find CPA and tax accountants do a disservice to business owners in how they minimize taxes. The result: it becomes nearly impossible for the business owner to get financing when they need it! If this is your situation, BGS will help as best we can. However, on the back side of this crisis, you may want to consider evaluating who’s providing you with accounting and financial advice to grow your business.

Financial Relief for Individuals

You, like us, you want to make sure your family is financially secure while dealing with your small business. Remember that if you and your family qualify, you have the individual financial relief coming your way too. This should help reduce more of your financial stress. Here are some of the key points to consider from the CARES Act meant to help you and your family personally.

You, like us, you want to make sure your family is financially secure while dealing with your small business. Remember that if you and your family qualify, you have the individual financial relief coming your way too. This should help reduce more of your financial stress. Here are some of the key points to consider from the CARES Act meant to help you and your family personally.

- Immediate financial relief for those who need it most, including: seniors, disabled Veterans and those on SSD.

- Stimulus checks not considered taxable income for 2020.

- Expanded unemployment benefits provides support for those who have lost their jobs or seen their hours reduced through no fault of their own.

- Weekly benefit temporarily increased by $600,

- People usually excluded such as independent contractors, self-employed, etc. can participate.

- Each individual states administer unemployment benefits. Here’s Florida link so you can apply.

- Emergency Solutions Grants designed to keep people in their homes, there are several provisions in the CARES Act to help individual homeowners.

- For federally backed home loans (Fannie Mae, Freddie Mac, VA loans), evictions are suspended for the next 150 days and foreclosures for 60 days

- There is also a penalty-free forbearance on these mortgages for a period of up to six months if owners are facing financial difficulty during COVID-19.

- Lenders will not be permitted to furnish negative information to owners’ credit reports for this emergency forbearance. If you need to access these provisions, call your lender.

- Student loan debt relief is a six-month, penalty-free halt in federal student loan payments.

- This Frequently Asked Questions document provides more about how much you may receive.

xporn

xnxx

Phim sex

Uk Public Liability Insurance

How To Blur Out Your House On Google Maps

Pure Massage Riverview

Brendan Gallagher Girlfriend

World Cup Netherlands Vs Argentina

Marauda

Daily Lister Craigslist

Travel Insurance For Canada

Adullam Cave

Best Women S Soccer Players

Saudi Arabia Us

English To Bulgaria

Porn vido indan

Chopped Hazelnuts

Jordan Binnington Injury

Hopper S4

Tracksuit Set Women

Food In Portree Scotland

How Much Is A Fitbit

Aircraft Right Of Way Rules

You probably have a mountain of question and that is is why you’re feeling stress and anxiety. BGS Bookkeeping is here to help relieve some of that financial stress.

You probably have a mountain of question and that is is why you’re feeling stress and anxiety. BGS Bookkeeping is here to help relieve some of that financial stress.