Most small business experience cash flow problems at one time. But what really causes a cash flow problem?

Accountants tell you not enough cash coming in the business for what you’re spending causes cash flow problems. That’s great to know, but why isn’t cash coming in the business fast enough? Here’s what you need to be asking when you have a cash flow problem.

You see any number of different things can cause cash flow to lag. If you don’t know what’s causing it how can you fix the underlying issue?

Those with a focus on sales usually concentrate there. But it’s not just closing enough sales that could be causing your cash flow problem.

What if it takes longer than expected to collect on invoices, would that cause a cash flow problem? Sure, you don’t have the money when you expected to pay bills after you do the work. Additionally, it could be that you’re not producing fast enough to get the work out the door.

A Common Thread in Cash Flow Problems

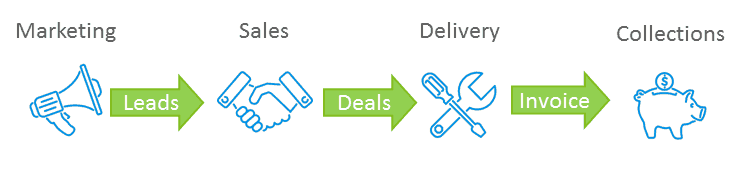

Do you notice the common thread here? If you don’t complete work fast enough (sales, delivery, collecting) along the cash flow cycle, then you’ll create a problem. That’s because cash flows out as work is done. So, cash flow is just that, paying for work as it’s done and receiving payment for that work when it’s delivered.

So, the best way to fix this problem is increasing productivity. But how many business owners look here first when meeting a cash flow crunch? Not many, because they don’t measure their productivity, then they’d see a cash flow problem before it got there and could proactively fix it.

Other Places to Look for Problems

Here’s another common productivity issue that causes a cash flow problem. If you are closing too many sales (over productive) it is pointing to a pricing issue. Mainly it points to the fact that your prices are too low, which results in not bringing in enough revenue in door.

Still another productivity issue could be not getting enough leads in the door which means you need to do more marketing. Without enough leads sales slow which slows amount of work you have to bill for which causes cash flow problems.

One thing I will point out here is that none of these problems are financial problems. These are all operational problems! So, if you have a cash flow problem stop looking for a financial solution, it’s not a financial problem it’s an operational one.

Make sure that you understand tuning your revenue engine and apply it. Learn how to improve your productivity and you’ll rarely meet with cash flow problems in your business.

Let Business Growth Simplified help you figure out how well your revenue engine performs by giving you $100 off on a Revenue Engine Performance Checkup. Just click the button below to get $100 off.

Leave A Comment