Growth requires specific things occur at specific time within the company both scaling back and up. There is a cause and effect in everything you do with your business, but how do you know what to do and when to do it. We see example on both sides of scaling the business, let’s take a look at how to address it.

Growth requires specific things occur at specific time within the company both scaling back and up. There is a cause and effect in everything you do with your business, but how do you know what to do and when to do it. We see example on both sides of scaling the business, let’s take a look at how to address it.

Scaling Back and Up

When economic conditions turn downward many companies find themselves scaling back. Unfortunately, most begin cutting without understanding the impact of their cuts. This often leaves them worse off than when they started. Cutting back in the wrong place can harm your business more than no cuts at all!

Guess what? You’ll see the same problem when you begin growing uncontrollably. Most business owners wish they could see this situation, but scaling up can be even scarier than scaling back.

Guess what? You’ll see the same problem when you begin growing uncontrollably. Most business owners wish they could see this situation, but scaling up can be even scarier than scaling back.

Why you might ask? Because scaling up means taking on more employees and equipment. That translates into more capital investments which means increasing your risk. So, you better have the wherewithal to control it before you get there.

How to Control Scaling Back and Up

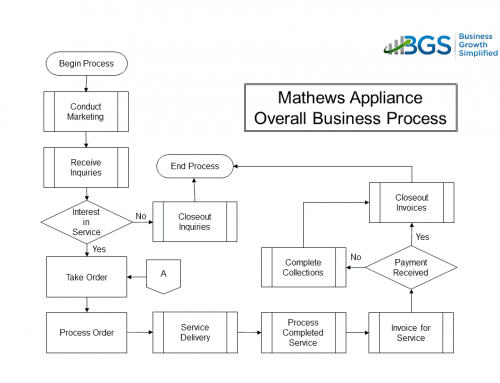

So, how do you know where to scale back or up? Easy, by understanding the dynamics of your revenue engine. Let me introduced you to a quick and very simple method to strategically understand the cause and effect of your actions on your business.

The “revenue engine” is made up of your marketing, sales, and operations functions. It is what you do to make money in your business.

You know how important it is to measure what is happening in each function. But, even more critical is knowing how changes in one function impact the others. For example, if you want to increase sales, how much can you increase sales before you reach your operational capacity? Not knowing this choke point can destroy your business faster than under performing sales!

Help Getting Started Tuning Your Revenue Engine

Get a $100 OFF your Revenue Engine Performance Checkup and find out the critical values you should be monitoring to make more effective decisions and improve your company’s cash flow. Just click the button below to find out more.

Leave A Comment