The COO or chief operating officer is usually the second in command in a company, and according to HBR have a deep knowledge of marketing, sales, and operations. A fractional COO provides part time support to small businesses without a full-time need.

So Why Do You Need A Fractional COO in Your Small Business?

You probably started your business because you had a great idea or were great at what you did for someone else. But, you need a fully integrated business operation if you want business success, however without the skills it’s highly unlikely, you’ll get there. This is where a fractional COO can help.

You probably started your business because you had a great idea or were great at what you did for someone else. But, you need a fully integrated business operation if you want business success, however without the skills it’s highly unlikely, you’ll get there. This is where a fractional COO can help.

Most small business owners deliver their product or service well, but struggle when it comes to sales and marketing. Often, they don’t even understand the difference between sales and marketing, which quickly becomes a problem withing the revenue cycle.

How does the COO help?

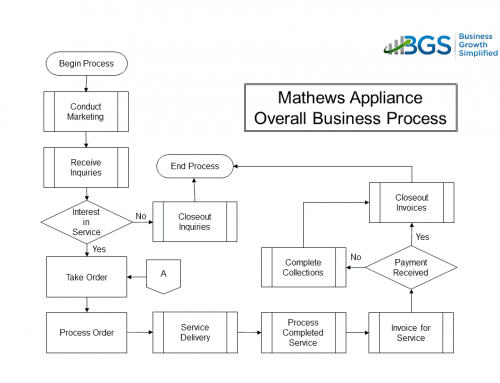

My mantra for over a decade has been tuning your revenue engine (TYRE). TYRE is a systematic process used by fractional COO’s to rapidly develop and monitor an integrated operation for small businesses. Watch the video below if you’re not familiar with TYRE:

How Do I Evaluate a Fractional COO?

Looking for a fractional COO requires some homework which can be difficult being the skills are so varied. Remember a COO integrates all aspects of your revenue cycle, marketing, sales and operations, so they need experience in all these business functions.

Looking for a fractional COO requires some homework which can be difficult being the skills are so varied. Remember a COO integrates all aspects of your revenue cycle, marketing, sales and operations, so they need experience in all these business functions.

A good place to start is LinkedIn. Review profiles to see what experience they have in these key business functions.

Remember your COO as an executive and needs strong strategic competency, then the ability to lead strategy implementation. A good rule of thumb includes reviewing their leadership experience at a director level or higher within companies where they’ve worked.

Remember your COO as an executive and needs strong strategic competency, then the ability to lead strategy implementation. A good rule of thumb includes reviewing their leadership experience at a director level or higher within companies where they’ve worked.

A big mistake many owners make is searching for industry experience. You want someone with a fresh perspective when evaluating and setting up your operation or you end up just like everybody else! Industry experience is better served at the manager level, which is where a knowledge of the industry can help in execution.

Do You Need A Fractional COO?

Only you can answer this question, but here are some questions to help you decide:

Only you can answer this question, but here are some questions to help you decide:

- How much revenue is your business currently capable of generating?

- Can you successfully hit your revenue goal for the year?

- What is your operation’s maximum capacity limit and when will you hit it?

- How much capital does it take to support your revenue goal and when do you need a capital infusion?

- Are your prices set correctly, or are you leaving money on the table with every sale?

- How many more sales must you close to reach your annual revenue goal?

- Do your current marketing efforts generate enough leads to support the sales team in reaching the revenue goal?

If you can answer all these questions, then congratulations you’re in great shape. COO competencies seem to be part of your skillset. If you aren’t sure of the answers or can’t answer some of these questions you might need the help of a fractional COO.

DE, Inc. offers fractional COO Services and offers a FREE Revenue Engine Performance Checkup to help you figure out. Schedule time for yours using the form below.

Leave A Comment