If your life hasn’t been affected by the corona virus, then you’ve been sleeping under a rock! And if you own a business how do you survive during the corona virus crisis multiplies your stress level by a factor of ten!

Email fills your mailbox daily from vendors and suppliers assuring you they’re acting as required by the government mandates and here to help and serve you. But quite frankly, that’s the last thing on your mind! You’re just trying to figure out “how do I keep the doors open!”

Email fills your mailbox daily from vendors and suppliers assuring you they’re acting as required by the government mandates and here to help and serve you. But quite frankly, that’s the last thing on your mind! You’re just trying to figure out “how do I keep the doors open!”

With leads to find; sales to make; and what orders there are to fill about to worry about you feel trapped in a maze. Now, add figuring out how to pay your bills, suppliers, and employees on-top of trying to make sure everyone stays healthy, no wonder your stress-level is through the roof.

How Does a Small Business Survive During the Corona Virus Crisis?

My passion is helping business owner create successful businesses. So, I’ve been watching the advice given by many advisors. And I must say, I’m more than a little under impressed!

Many of the immediate symptoms you are experienced are escalated by your fear. Why? Because many small businesses lack the operational data necessary to see what’s actually happening in their business.

Accountants and CPA’s immediately jump on the money problems. And while I agree, cash flow will be the immediate problem for small business owners, the solutions offered by financial advisors are only band aid on the cash flow symptom you’ll experience (if you haven’t already).

Accountants and CPA’s immediately jump on the money problems. And while I agree, cash flow will be the immediate problem for small business owners, the solutions offered by financial advisors are only band aid on the cash flow symptom you’ll experience (if you haven’t already).

Let me explain what I mean. In an email I received from a fractional CFO company, here are the suggestions offered to weather the storm:

- assess your cash flow cycle

- review your receivables levels evaluate the likelihood of payment

- rank your accounts payable and decide what you can pay and when

- Stay in contact with your vendors and suppliers regularly

- Cut back on added expenses like bonuses and other nonessential payments

- Create a cashflow statement with different possible scenarios evaluated

In a nutshell they’re saying, “hunker down and see how long you can last.” While I’m not saying you don’t need to do these things, you should have already been doing them, but they become more critical in a time of crisis for sure.

By taking this approach you take a defensive posture in your business like a turtle pulling in his shell. As a result, your chance of survival diminishes greatly because you chose a defensive strategy.

Taking Offensive Action to Survives and Thrive

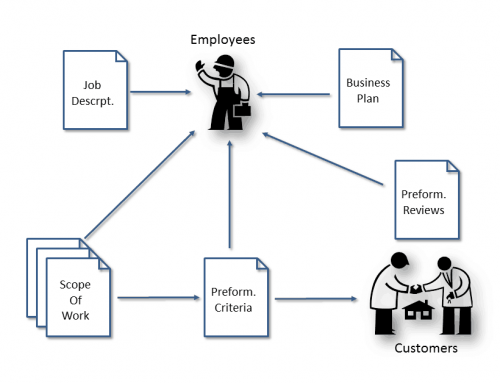

The one thing they did say that is key is “assess your cash flow cycle.” The problem is they do it from a financial perspective. But you need to look at it from an operational transaction perspective which means your applying Tuning Your Revenue Engine (TYRE). Watch the video below for an overview:

By monitoring the activity of your operation, you can see where it’s slowing down. Now, you can assess why. Is the problem something within your control, or has a shift in the market occurred which is completely out of your control?

Now you can search for the right solution which will fix the REAL underlying root-cause issue. Fixing the root-cause increases your efficiency, saving you time and money and improving you cash flow.

Now you can search for the right solution which will fix the REAL underlying root-cause issue. Fixing the root-cause increases your efficiency, saving you time and money and improving you cash flow.

But, root-cause fixes become permanent in the operation. They result in accelerating your growth and profitability when things begin to return to normal.

Let’s Look at a Few Examples:

You own a restaurant and the city has said restaurants must limit seating to 50%. That means their capacity has shrunk by half. If you only half the operation, then you need to cut the staff by half. Pretty easy, but you’d be surprised how many small businesses struggle to make this decision. If you don’t cut back right from the start, then your business won’t survive the corona virus crisis.

Next, let look at a product supplier. Their customers have cut way back as many of the customers’ staffs are working from how. Sales have slowed dramatically, nearly 60% in the last week and from calls made by the sales team this will probably be the case for at least the next 4-6 weeks. Well, 60% less orders means less deliveries, so the owner needs to cut back on delivery stay and sales staff for the next 4-6 week. By tuning the revenue engine this owner has a good chance her business survives the corona virus crisis.

Next, let look at a product supplier. Their customers have cut way back as many of the customers’ staffs are working from how. Sales have slowed dramatically, nearly 60% in the last week and from calls made by the sales team this will probably be the case for at least the next 4-6 weeks. Well, 60% less orders means less deliveries, so the owner needs to cut back on delivery stay and sales staff for the next 4-6 week. By tuning the revenue engine this owner has a good chance her business survives the corona virus crisis.

Finally, orders are up in the local grocery store as people tend to be hoarding product as they panic from the news reports and requirements to stay at home. This owner needs to stay ahead of the demand, so he should be ordering additional inventory and brining in extra staff to keep the shelves stocked. If customer see the store has what they need, then they are more likely to return knowing this owner is doing all he can to help them and his business survives the corona virus crisis.

How You Can Take Action so Your Business Survive During the Corona Virus Crisis

To understand where your chokepoint exists and its root-cause you just need to apply the revenue engine model to your business. The calculations will give you’re the metrics necessary to proactively take offensive action during a crisis or for growth in the good times.

There are several options available at various price points depending on your budget and comfort-level applying it yourself. Click the link to find out more.![]() The most cost-effective and least time-consuming way to get started is by scheduling a FREE 30-minute Revenue engine Performance Checkup. Just find an open time on the calendar below and schedule your FREE consultation.

The most cost-effective and least time-consuming way to get started is by scheduling a FREE 30-minute Revenue engine Performance Checkup. Just find an open time on the calendar below and schedule your FREE consultation.

Leave A Comment